non filing of service tax return

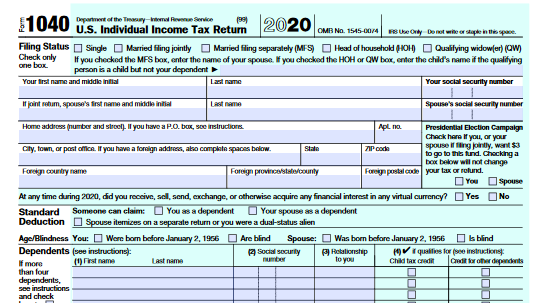

C onsequences of non-filing of Income Tax Return AO can issue notice us 142 1 if the return is not filed before the time allowed us 139 1. The upcoming due date for Income tax.

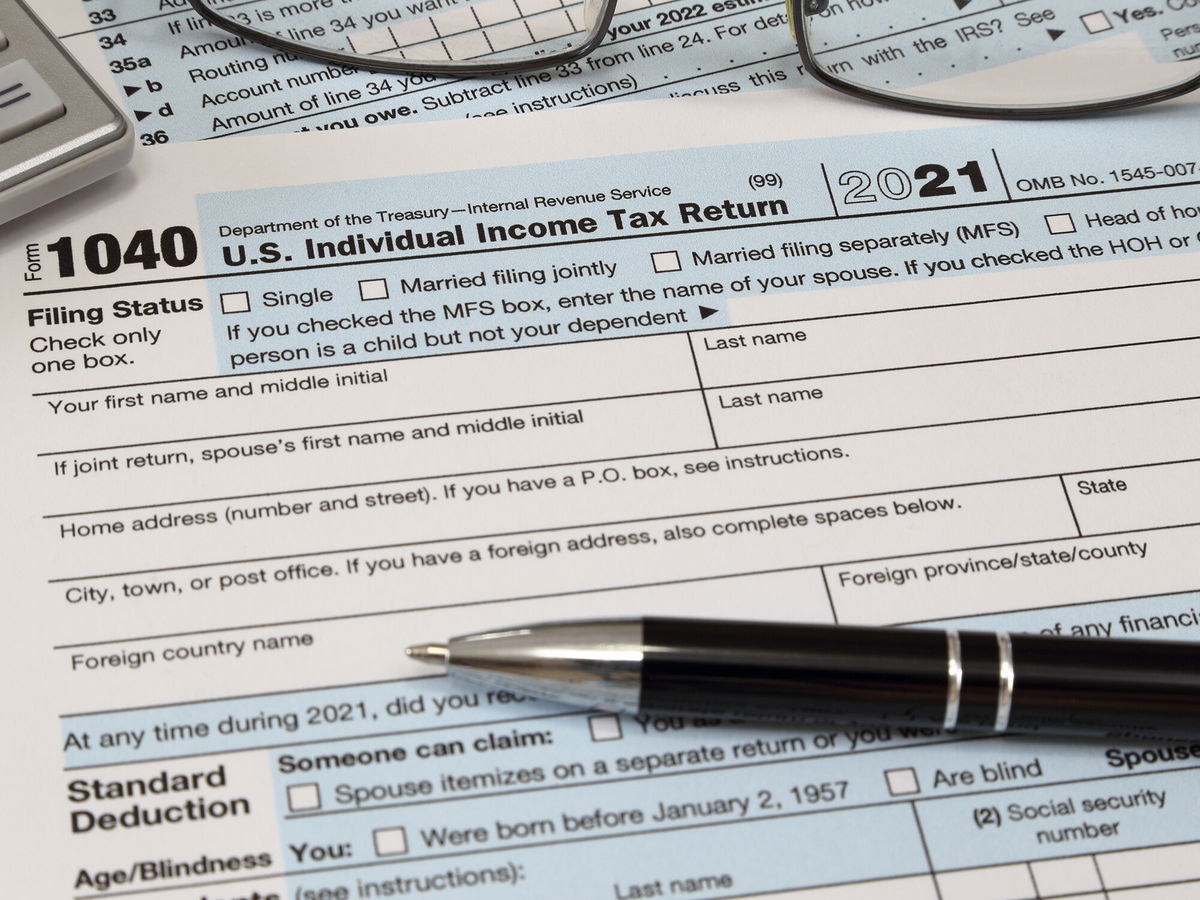

Today Is Tax Day Here S What You Need To Know About Filing Your 2021 Taxes Kesq

What is non filing of income tax return.

. Concealment Penalty will be Issued. Section 701 of the Finance Act 1994 Act for short provides that every person liable to pay service tax shall himself assess the tax due on the services provided. When I am not.

Nil Service Tax Returns Penalty. The assessee will have to file NIL Return as long as the Registration of the. If I am not liable for payment of Tax then by virtue of Section 657 I am NOT an assessee.

Penalty for late filing of Nil return - Held that- in view of the Boards Circular No97807-ST dated 23082007 in the event no service is rendered by the service provider there is no requirement. If the service tax return is not filed as per the mentioned due dates above penalties are levied on the basis of duration for which service tax filing is delayed. Filing of returns.

Revised Service Tax ST-3 return can be filed within a period of 90 days from the date of filing the original return. First 15 days- Rs500. The central government has extended the deadline for filing the income tax returns for the AY 2021-22.

As of the date of. The last date for filing the income tax return for tax year 2021 was September. If we consider the point 1 then you have to file the service tax return else for.

The service tax late. An IRS Verification of Non-filing Letter will provide proof from the IRS that there is no record of a filed tax form 1040 1040A or 1040EZ for the year you have requested. 465 from 566 votes.

We are sharing with you an important. Liability of service tax GST - service rendered to Haj pilgrims - Pl. In just recent past this provision was amended from penalty of Rs.

Service Tax in respect of non filing of Service Tax Return Service Tax in respect of non filing of Service Tax Return Details Last Updated. The Federal Board of Revenue FBR issued Circular No 7 of 2021-2022 to explain the amendment. PDF ePub eBook Category.

Difficulty in obtaining GST registration -. If assessee has not provided any Taxable Services during the period for which he is required to file the return still it is in the interest of the assessee to file. If you have assessable income yet have not filed returns you will be served with a penalty because you have concealed your income.

No Need to file Service Tax return ST-3 when no service is rendered during the relevant period and even not required to opt for VCES. Wednesday 22 February 2017 0638 Published. Thus we can say Persons who are not liable to pay service tax because of an exemption including turnover based exemption are not required to file ST-3 return in terms of.

No one likes filing their taxes but not filing them at all is never a good idea. Prior to this the last date to file the income tax returns was December 31. The minimum penalty for failing to file within 60 days of the due date 210 or 100 percent of your unpaid taxes whichever is less.

If requested on your FAST page please. So as we discussed above that NIL Service tax returns can be filed or not. Filing of NIL Return of Service Tax.

An assessee is liable to file the service tax return even if there is no taxable turnover under service tax. With all listed above the non-filing or delayed filing of the ITR would impact you with adverse consequences especially for the businesses. The failure-to-file penalty grows every month at a set rate.

Section 77 charges penalty on non-filing of returns maximum up to Rs. If I am not an assessee then filing return under rule 7 does not arise. Condonation of delay in filing appeal - extension of condonable period.

Carry forward of Losses not allowed.

Is It Illegal Not To File Your Taxes If So Why Taxrise Com

No Need To File Service Tax Return If There Is No Service Tax Payable

Rs 100 Per Day For Non Or Late Filing Of Service Tax Returns Advisory Tax And Regulatory Compliance In India Singapore And Usa

Returns Filed Taxes Collected And Refunds Issued Internal Revenue Service

Articles About Federal Tax Issues From The Lawyers Of Silver Law

Indian Americans What Not To Forget While Filing Us Taxes The Economic Times

Are There Irs Penalties If I Request A Tax Filing Extension

Verification Of Non Filing Notice Sent But I Filed In March R Irs

Does Everyone Need To File An Income Tax Return Turbotax Tax Tips Videos

Didn T File Tax Return Or Pay Up Here S Help

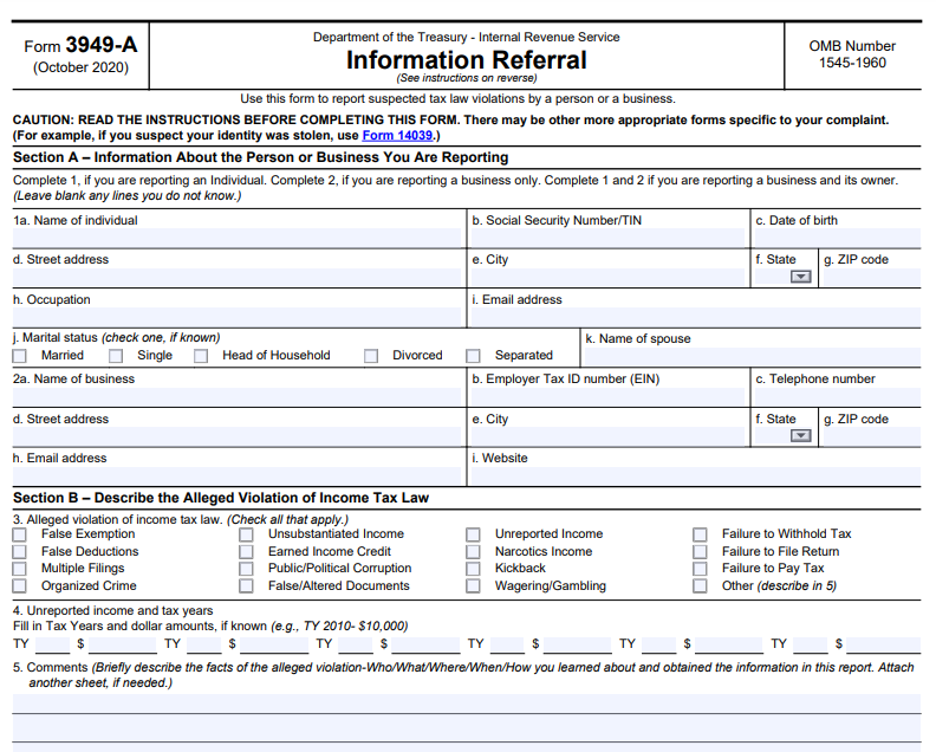

Can Someone Turn Me In To The Irs Jackson Hewitt

Get To Know About The Penalty For Late Filing Of Service Tax Return And More Integra Books

Irs Tax Transcripts Financial Aid Office Suny Buffalo State College

How Filing Tax Returns Late And Unpaid Taxes Affect Your Bankruptcy Case

Md Tax Day 2019 Late Filing Tips Postal Hours Annapolis Md Patch

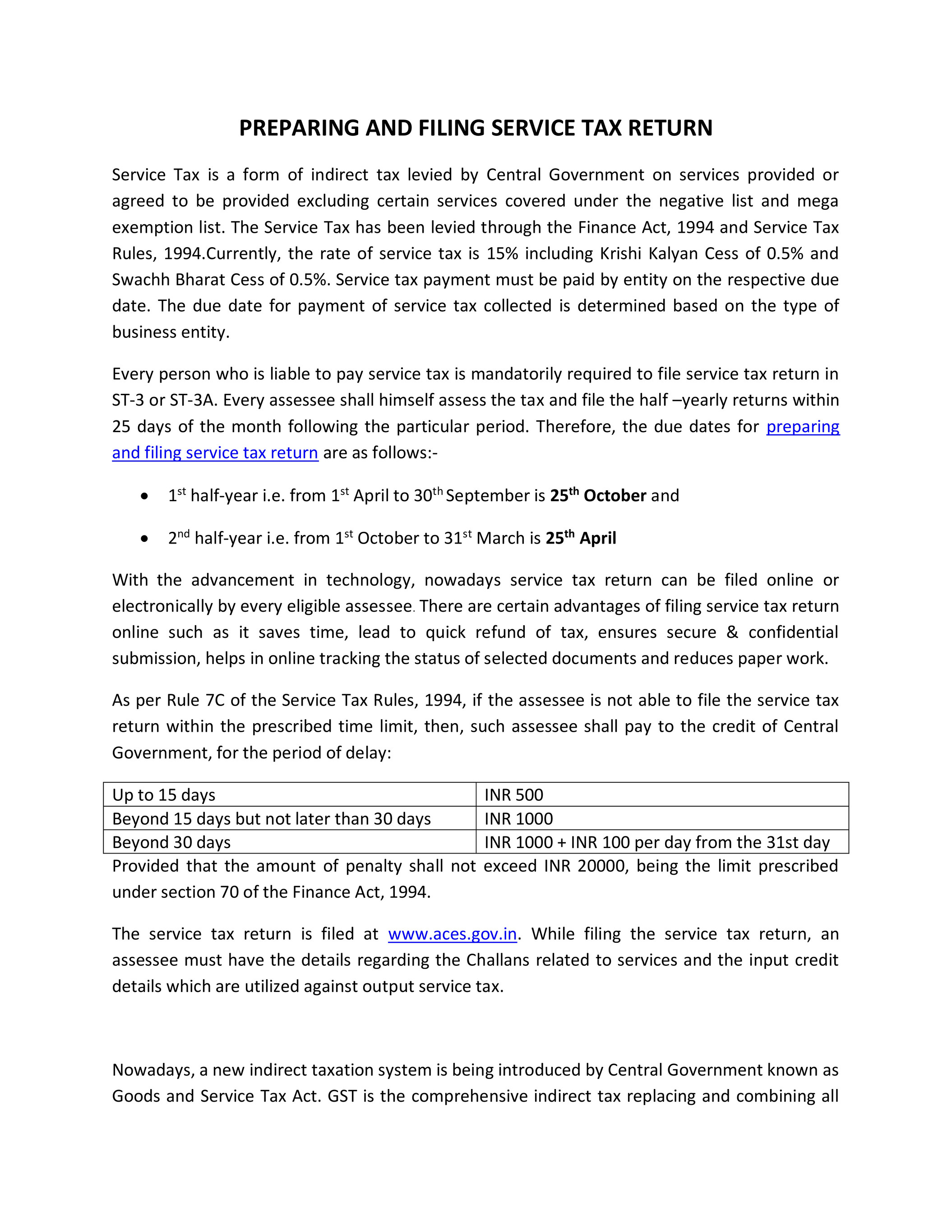

My Publications Preparing And Filing Service Tax Return Page 1 Created With Publitas Com

What Is An Irs Verification Of Non Filing Letter Niner Central Unc Charlotte